Risk management

Risk Management – Assessment, Investment diversification, Tolerance, Mitigation strategies Risk management is an integral aspect of financial advisory services, ensuring individuals and organizations navigate the complex landscape of investments and finances with prudence and strategy. A financial advisor’s role encompasses various critical elements, including risk assessment, investment diversification, and insurance planning. These professionals meticulously evaluate […]

Insurable interest

Insurable interest with Ascendant Financial What is Insurable interest? The term “insurable interest” is used to describe the legal and financial interests of a person or company in an insurance policy. It means, in simple terms, that the person or entity buying the insurance has a stake in protecting the insured property or person. The […]

Inheritance tax

Inheritance tax with Ascendant Financial What is Inheritance tax? The term Inheritance Tax (IHT), stands for an amount that’s payable by a person who has received assets upon another individual’s death. The asset range includes cash, real estate properties, business shares among others. This emphasizes how important it is to understand optimal inheritance tax literature […]

Income tax

Income tax with Ascendant Financial What is Income tax in Canada? Income tax is the percentage of your earnings (business or personal) that you pay to the government. Canada’s income tax system is graduated, meaning that your tax rate will depend on what you earn. Canada Revenue Agency (CRA), which manages the income tax revenue, […]

Corporate tax

Corporate tax with Ascendant Financial What is Corporate tax? Corporate tax, or the corporate income tax, is a tax that is levied on profits or incomes generated by businesses or corporations. Corporate taxes can be levied on income produced from the business activities and income produced on property such as investments. The government imposes a […]

What Are The Financial Risks of Having Only One Primary Beneficiary?

What Are The Financial Risks of Having Only One Primary Beneficiary? Why Do I Need A Primary Beneficiary? When you have a life insurance policy, you may be concerned with dividing up the benefit amount and who will take responsibility for your children or other dependents after your death. Additionally, there will be many obligations […]

Liability

Liability What is Liability? Liability in financial accounting is a financial obligation that a company or individual has to another party, such as a loan or other type of debt that have to be paid back at a specific time or when certain conditions are met. In his book, Rich Dad Poor Dad, Robert Kiyosaki […]

How Can Termination of Employment Affect Your Group RRSP?

How Can Termination of Employment Affect Your Group RRSP? Have you been working for an employer that offers group RRSP? The group RRSP plan is often a carrot used to attract talent and keep employees. So what happens if you no longer work there? What happens when you are fired or terminated? When you lose […]

The Biggest Fears Of Registered Retirement Savings Plans

The Biggest Fears Of Registered Retirement Savings Plans When most people listen to the word “RRSP,” they think of “retirement.” Popular media is filled with information about retirement savings, and most professionals recommend that everyone start saving at least 20% of their income. This means that many individuals face an important decision: when to start […]

Return On Investment

Return On Investments in Canada What is ROI ? Return On Investment (ROI) is the measurement of how profitable an investment is. An ROI calculation should help evaluate the efficiency of an investment. By comparing how much you put into an investment versus what you earned from it, you can assess performance. Every investor […]

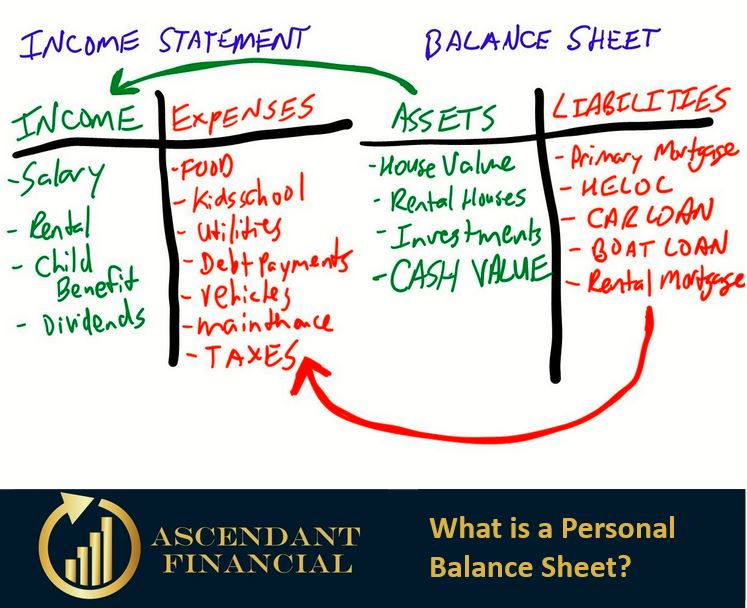

Personal Balance Sheet

Personal Balance Sheet What is a personal balance sheet? A personal balance sheet Also referred to as a personal financial statement, a personal balance sheet is a document that outlines an individual’s personal financial position at a given time, detailing the liabilities, assets. Do you know your net worth? Find out your worth by creating […]

Individual Retirement Accounts In Canada

Individual Retirement Accounts In Canada What are Individual Retirement Accounts? Canada has many types of retirement accounts that are available. The most commonly discussed around the water cooler are the TFSA and RRSP. However, there are many more to note. You may even have one of these or end up with one in the future. […]

What Insurance premiums are tax deductible?

Tax Deductible Insurance Premiums New Training From Jayson Lowe: Click Here To Start! What Insurance premiums are tax deductible? Tax deductions are sought after by most Canadian families and businesses to reduce our taxable income for the year are critical. But beware..the taxpayer is always the one who is impacted if they do something incorrectly. […]