Risk management

Risk Management – Assessment, Investment diversification, Tolerance, Mitigation strategies Risk management is

Becoming Your Own Banker is a financial strategy focused on your benefits not the banks benefits. A way to grow your future financial success and the potential of a dividend-paying life insurance. It’s neither a sales nor a marketing tool for whole life insurance brokers.

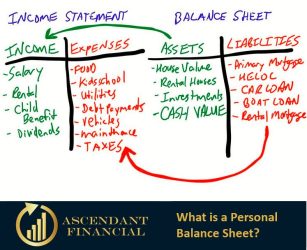

The Infinite Banking Concept is a process, not a product. The whole idea is to recapture the interest that one is presently paying to banks and finance companies for the major items that we need during a lifetime, such as vehicles, property, investment opportunities, business equipment, etc…

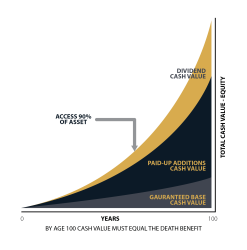

The ability to borrow from a life insurance asset, called cash value, has been common knowledge for many years. However, there are many details about the advantages of borrowing from insurance that are unknown to the general public.

The money multiplier is generally referring to a formula used in macroeconomics and stemming from the Keynesian school of economic thought. It is typically aligned with the concept of fractional reserve banking and how the overall money supply can be increased…

PUA (PUAR) rider or simply the paid-up additions rider is a unique feature of insurance that has been discussed at length in designing a policy or system of policies that would enable the policy owner to properly implement The Infinite Banking Concept…

You already know that Life Insurance can help protect your business by making funds available to pay off debts, to fund buy sell agreements, and keep the business running. But did you know it can also benefit you and your business during your lifetime?

Canada has many types of retirement accounts that are available. The most commonly discussed around the water cooler are the TFSA and RRSP. However, there are many more to note. You may even have one of these or end up with one in the future.

Like other people globally, Canadians often have new year resolutions and dreams of improving their financial situation. However, these goals never seem to see the light of day. In fact, a report has it that 80% of these dreams don't reach the quarter-year mark…

Life insurance is a contract between the insurance policyholder and the company. If you pass away during the term of the contract, the insurance company promises to pay the death benefit in terms of tax free money to those you designate as beneficiaries.

Risk Management – Assessment, Investment diversification, Tolerance, Mitigation strategies Risk management is

Insurable interest with Ascendant Financial What is Insurable interest? The term “insurable

Inheritance tax with Ascendant Financial What is Inheritance tax? The term Inheritance

Income tax with Ascendant Financial What is Income tax in Canada? Income

Corporate tax with Ascendant Financial What is Corporate tax? Corporate tax, or

What Are The Financial Risks of Having Only One Primary Beneficiary? Why

©2023 Ascendant Financial All Rights Reserved | Terms & Privacy Policy | DMCA

© 2023 Ascendant Financial Inc. All rights reserved.

The supporting material, audio and video recordings and all information related to Introduction to Becoming Your Own Banker, The Infinite Banking Concept (IBC) posted on www.ascendantfinancial.ca and all other Ascendant Financial Inc. websites are designed to educate and provide general information regarding The Infinite Banking Concept (IBC) and all other subject matter covered. It is marketed and distributed with the understanding that the authors and the publishers are not engaged in rendering legal, financial, or other professional advice. It is also understood that laws and practices may vary from province to province and are subject to change. All illustrations provided in these materials are for educational purposes only and individual results will vary. Each illustration provided is unique to that individual and your personal results may vary. Because each factual situation is different, specific advice should be tailored to each individual’s particular circumstances. For this reason, the reader is advised to consult with qualified licensed professionals of their choosing, regarding that individual’s specific situation.

The authors have taken reasonable precautions in the preparation of all materials and believe the facts presented are accurate as of the date it was written. However, neither the author nor the publishers assume any responsibility for any errors or omissions. The authors and publisher specifically disclaim any liability resulting from the use or application of the information contained in all materials, and the information is neither intended nor should be relied upon as legal, financial or any other advice related to individual situations.

Family Banking System (FBS)™ is a trademark of Ascendant Financial Inc. © Ascendant Financial Inc., 2024. All rights reserved. The phrase “Live the Lifestyle, Love the Process, Infinite Banking” is a registered copyright (Registration No. 1209863) with the Canadian Intellectual Property Office. Unauthorized use, reproduction, distribution, or copying of this phrase, in whole or in part, without express written permission from Ascendant Financial Inc. is strictly prohibited. This copyright is protected under Canadian intellectual property laws and regulations. Any unauthorized use is subject to legal action and enforcement under Canadian law. For inquiries or requests for permission to use this copyright, please contact Ascendant Financial Inc.

The Infinite Banking Concept® is a registered trademark of Infinite Banking Concepts, LLC. Ascendant Financial is independent of and is not affiliated with, sponsored by, or endorsed by Infinite Banking Concepts, LLC.”

This content is intended for Canadian residents of BC, AB, SK, MB, ON, NB, NS, NU, YT, PEI & NFLD only.