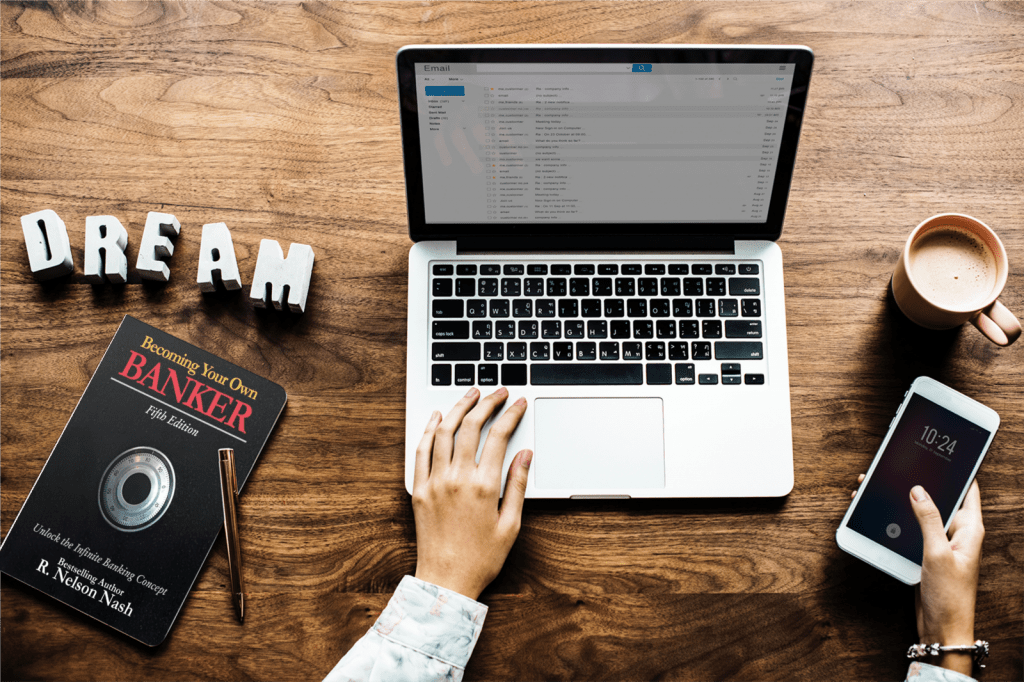

Borrowing from Life Insurance Expert

Get access to our on-demand training & discover exactly how borrowing from life insurance can work by hearing examples. Let one of our financial experts show you how you can benefit from Borrowing money from your life insurance.