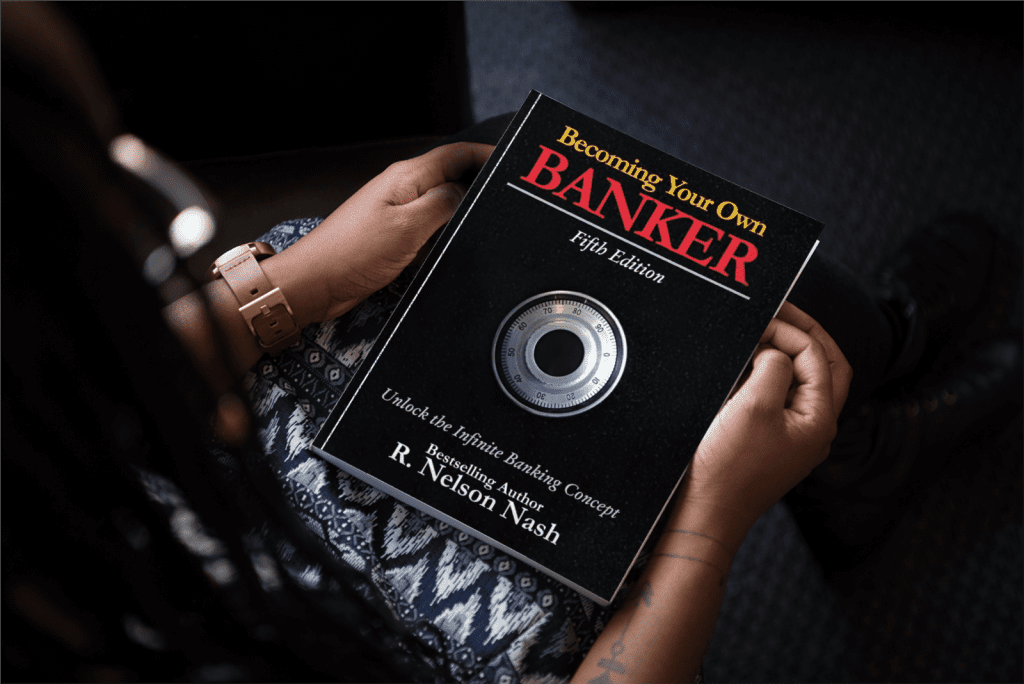

How does infinite banking work?

Infinite banking works by purchasing a dividend-paying whole life policy from a mutual insurance company. The individual is then able to borrow against the policy’s accumulated cash value growth, using policy loans that would not require credit checks, and their credit score remains unaffected. It is worthwhile to note that such an approach offers a unique blend of a life insurance coverage that is broader than a term life insurance policy with a cash flow strategy that benefits from significant tax advantages.

When managing these accounts, many prefer to work with a financial advisor to ensure they are maximizing their potential benefits. Here, sheathed from market volatility, the account can function much like a high-yield savings account, available for funding unexpected expenses or even planned significant outlays. Any borrowing is then repaid back into the account, increasing the policy's balance, allowing for further cash value growth. In the realm of infinite banking, the dual advantages of managing personal expenses while enjoying continuous growth offer a truly innovative way to look at personal finance.

What are the Advantages of Infinite Banking?

The Infinite Banking advantages are:

- Protects against financial uncertainties by positioning life insurance as a significant asset

- Allows borrowing from policy loans for financial needs like medical bills or credit card debts

- Offers a non-correlated asset unaffected by market turbulence

- Provides a more stable path for investment strategies

- Enables access to liquid assets (cash value) at any time for any purpose

- Maintains consistent monthly payments and life insurance premiums regardless of cash value usage

- Shields assets from creditors in many jurisdictions

- Creates an economic safe haven through protected cash value and death benefits

- Promotes tax-free growth of cash value

- Diverges from traditional life insurance industry norms

- Alleviates concerns about outliving one's money

The infinite banking concept positions your life insurance policy as a significant asset to protect you against financial uncertainties. You can borrow from the life insurance policy loans, in the case of financial need, like medical bills or credit card debts.Unlike borrowing from a bank or a credit card, this policy loan is a non-correlated asset, unaffected by market turbulence, offering a more stable path for your investment strategies. A salient advantage of the infinite banking life insurance is its liquid asset capability. In other words, your cash value can be used any time, for any purpose, without affecting the frequency of your monthly payments or your life insurance premiums. This type of life insurance also harbors a unique resilience to creditors seeking payment. In many jurisdictions, the cash value and death benefits of life insurance are protected from creditors, providing an economic safe haven. Additionally, the infinite banking model promotes tax-free growth of cash value, distancing it from traditional life insurance industry norms. It's a strategy that encourages storing many months of living expenses without the concern of outliving your money.

Are there Disadvantages of Infinite Banking?

While recognizing the many benefits of infinite banking, one must also weigh the potential drawbacks. The Infinite Banking system requires a significant commitment and a certain degree of risk tolerance. Unlike traditional investments such as real estate where you can see growth or returns almost immediately, the accumulation of cash value in an infinite banking policy over time is a slow process, similar to how continuous compounding works. Instead of offering immediate or short term gains, it builds a financial foundation for the long term and thus requires a substantial period of time to see substantial results.

Alongside this, access to funds can also pose a challenge. Although the infinite banking concept, a registered trademark, does provide protection from creditors, it does not guarantee unrestricted access to funds sheltered in the policy. This could limit cash flow and immediate investment opportunities in your estate. Your tax bracket also plays a role in how beneficial the policy is; individuals in higher tax brackets will see more benefits. Lastly, the cash surrender value of your policy can affect the opportunity of gaining full advantage of your policy benefits in the early years. As a result, policyholders must carefully evaluate their financial goals and timelines before opting for this strategy.