What is the difference between term and life insurance?

Term Life insurance is prevalent. It is the most common form of coverage that people start within life when they are young and looking to get basic life insurance to protect their family, business or make sure their debts are covered.

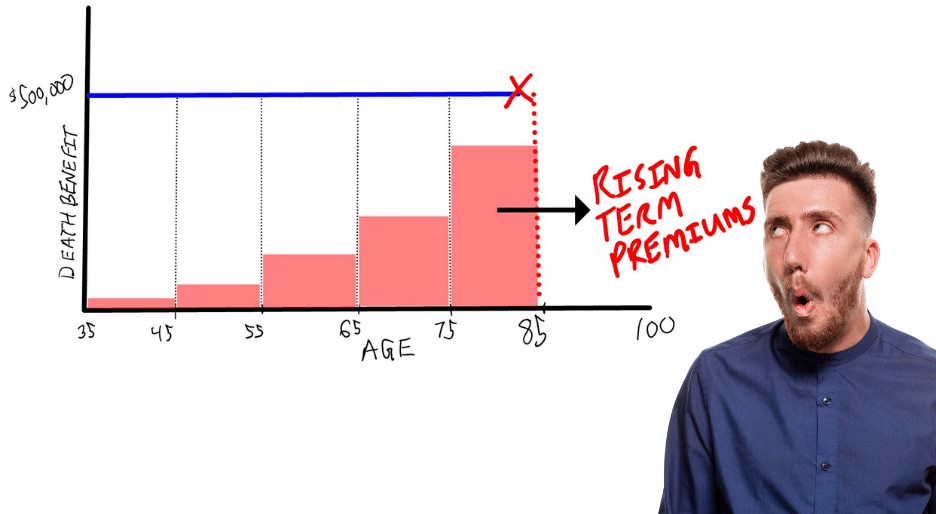

Here are some widespread term insurance options offered by most insurance carriers in Canada. Keep in mind term coverage for an amount of death benefit where the premiums are locked in only for a specific period of years. Then at the end of that term, as the insured person is now older, the premiums must rise to continue providing that benefit.

- Term 10 or T10

- Term 20 or T20

- Term 25 or T25

- Term 30 Or T30

- Term 100 or T100 (this is technically considered a permanent policy. It is a level cost of premiums to age 100 for a given amount of coverage but has no cash value)

There may be many other formats as every company creates their model of term coverage. But Term 10 and Term 20 are widely the most used in Canada today.

Here is the problem, the terms can vary dramatically, and the only way an insurance company can offer term life insurance at a low cost for several years is if they have a statistical method to make up for it. Stay tuned as we describe an example.

What are the disadvantages of term life insurance?

The story of renting versus owning is a good analogy to help someone understand what term insurance is. A term policy is like getting a lease on the house to rent for your family for an extended period versus buying the home and building equity through mortgage paydown and appreciation. If you have a term policy, that is good you have protection for your family… but it isn't a financial plan. It's the equivalent of going to vegas and trying to beat the house. You are betting that you will die during the term and put very little money in, and the insurance company is on the hook to pay a vastly more significant amount of money, income tax-free, to your beneficiaries.

Why would the insurance company do that? It's simple. They understand statistics. Less than 3% of all term insurance policies (excluding term to 100) will pay a death claim. It's nothing the insurance company has done. It's a function of probabilities.

Put yourself in the insurance companies shoes for a moment.

Imagine getting a basic Term 10 policy for $500,000 to protect your families and ensure your mortgage and other debts are covered. At age 35, a standard non-smoking male premium would be $27-$35 per month. Let's use $30. Now the insurance company looks at a “field of selected lives.” People who have a similar build, non-smoking health condition and family history traits. And they know over the next ten years, if they have 1,000 people just like that, they would generate premiums of $30,000 per month. Over the first year, minus any lapses, they would have $360,000 plus any earning that could happen on those dollars. Over the ten years, that would be $3,600,000 in gross premiums (assuming no policies get cancelled). Of course, they have to subtract operation costs, employee wages, the cost of their office, taxes, nurses and doctor reports etc. But they know statistically, they will only lose 1.5 -3 of those 1000 people over the first ten years. That is the power of “risk-pooling.” After all, insurance companies are in the business of managing risk.

Now shoot forward to age 45. Ten years older and ten years closer to meeting the grim reaper. The risk of increased payouts to the life company has gone up. To continue providing the same $500,000 benefit to the remaining 997 people (assuming three passed away), they need to increase the premiums for the next ten years to make sure they can guarantee the payout amounts. From age 45 – 55, the premium for the same male person now jumps to $160 -$170 per month. Many people are forgetful that this will happen even though the advisor clearly told them ten years ago…they often get upset and cancel the plan, refusing to pay the increase and leaving their family with no protection.

Suppose we look at the increase of $160 – $30 = $130 per month increase in premiums. That is a 433% increase in premium on the insured person. Then again, from age 55 – 65, the premium must rise to cover the increased risk of payout. It now goes up to $385-$400 per month or a $225 monthly increase for our same sample individual. To be clear, the insurance company has pledged a significant liability of $500,000 to lots of insured people. Just imagine if all the 997 remaining people in that pricing group passed away, it would be a $498,500,000 payout required by the insurance company!

Meanwhile, the policy owner has still put far less in than the benefit they may receive at this stage of the game. In this example, the 35-year old who keep this plan in force for 30 years would have put in roughly $69,000 in premiums before likely terminating the policy if still alive…but they had tax free death benefit of $500,000 and peace of mind to protect their family over the whole period.

They rented the benefit, and they have nothing on paper financially to show for it other than some reduced stress over 30 years that if they passed on early, the family was protected, but they had no equity or Ownership. Contrast that to Participating whole life insurance, which builds up substantial cash values where you get access to every dollar of premium you contribute to use as working capital during your prime earning years. At the same time, you are alive and have increased protection versus the flat-level protection of the term insurance, which doesn't increase. Plus, with well designed whole life, the tax-free death benefit is also constantly growing to provide even more value to the next generation. Whereas after age 65, the term insurance would likely terminate, the whole life machine continues to protect and provide value until the very end. Even better, it can help provide augmented retirement income to support all of your goals and objectives.

Meet with one of our financial professionals and get a complimentary review of your current insurance coverage. Ask questions and learn what options are available to you and your family.